Quarterly report | Q4 | Baltic States

Property

Snapshot

Q4 | 2021

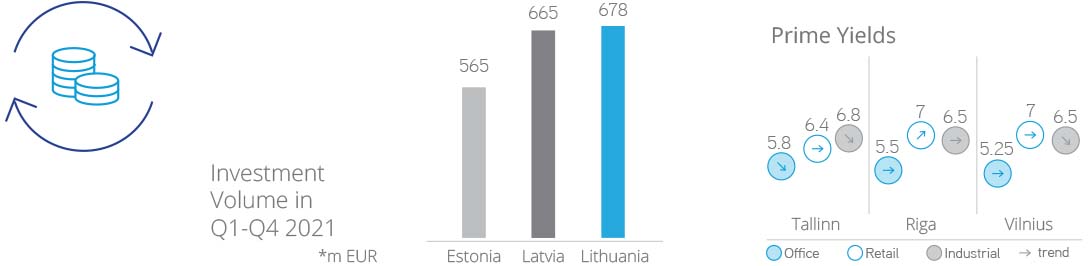

Investment market

The capital market in Estonia finished the year with total investment volume reaching at least ca EUR 565 million, thus surpassing the previous year’s result by 68% and showing the second-best result so far. In Q4, total known investment volume amounted to ca EUR 300 million, driven by the sale of three properties (J13 LC, Rimi LC and Metro Plaza) by East Capital and boosted activity in the retail segment (58% of quarterly volume) which had remained rather calm so far. Lintgen became the new owner of the T1 Mall of Tallinn SC (distressed asset, sold at auction for EUR 55 million), while Stockmann sold its Tallinn department store to VKG (sale-leaseback deal). Skala Kapital acquired the Mustamäe Centre from East Capital and the newly developed Lasnamäe Prisma supermarket from a developer. Additionally, Finnish real estate fund Titanium became the new owner of Viimsi Market, while Lumi Capital acquired Priisle Selver supermarket. Other notable deals included the acquisition of the Paldiski 80 office building and the sale of Ülemiste Hotel located next to Tallinn Airport. Industrial and office prime yields continue to remain under downward pressure.

Key Investment Figures in the Baltic States, Q4 2021

Prime Yields

Estonia

Latvia

Lithuania

Office

5.8%

5.5%

5.25%

Retail

6.4%

7.0%

7.0%

Industrial

6.8%

6.5%

6.5%

Source: Colliers

In Q4 2021, an additional EUR 165 million was invested in Latvian real estate, meaning that the highest ever investment volume of EUR 665 million has been reached in Latvia – two times higher than the figures achieved during previous years. The largest part of investment volume came from retail deals, such as the sale of SC Alfa, SC Ozols, the newly built DEPO DIY in Imanta, SC Valdeka in Jelgava, Juglas Centrs and Stockmann DS which altogether were responsible for 48% of yearly investment volume. Currently the market is lacking prime objects for sale as once sold there is not much choice as to where to allocate the gains. This has resulted in investors facing a market of opportunistic and value-added investment options. Interest in development properties remains high with more than EUR 200 million invested during 2021. Prime office yield compressed by 10 bps to 5.5% and prime industrial yield compressed by 25 bps to 6.5%, a trend expected to continue.

Q4 2021 was characterized by good results and figures in Lithuania with total investment volume exceeding EUR 205 million and strong investor appetite for the office and industrial & logistics sectors. The hotel segment stood out with the acquisition of the existing 4-star Holiday Inn in the centre of Vilnius by Lords LB, this being the largest hotel transaction in the last three years. Large-scale deals in the industrial segment included the acquisition of Pigu, the last-mile distribution centre, by East Capital and the Biok Lab factory by Prosperus in the capital city and its surroundings, the sale of a 17,700 sqm industrial complex in Kaunas to Union Asset Management and the acquisition of the Rehau production facilities in Klaipeda by Hili Properties. However, the dominant part of total quarterly investment volume went to the office segment, including the acquisition of Uptown Park BC by Eastnine, Naujasis Skansenas Z BC by East Capital and Danske Bank BC by EfTEN Capital, all located in Vilnius.

Office market

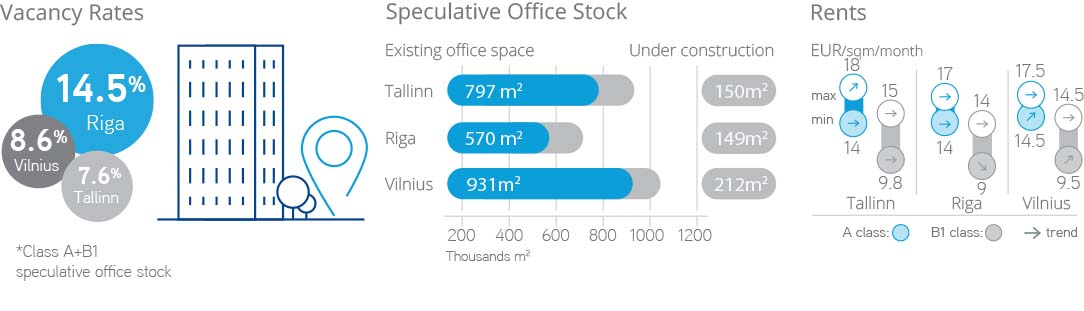

Development in the Tallinn office market remains active with total GLA of almost 150,000 sqm (13.6% of total stock; 17 projects) under construction in December. Q4 2021 saw completion of the Pärnu Rd 132 project (redevelopment) in the City Centre and Grüne Maja in Haabesrti, and the start of construction work on the Roseni Maja (Class A; 9,000 sqm) in CBD. Demand is continually driven by ICT, the blockchain industry, healthcare and professional sectors. Low new supply in 2021 (26,600 sqm in total) supported positive office space absorption throughout the year. Vacancy continues to fluctuate around 7-8%, seeing some decline in Class A and B1 buildings by the end of the year due to buoyant demand and a hike in the number of enquiries since September 2021.

Key Office Figures in the Baltic States, Q4 2021

Class

Tallinn

Riga

Vilnius

A Class Rents

14-18

14-17

14.5-17.5

B1 Class Rents

9.8-15

9-14

10-15

A Vacancy*, %

7-8%

16-17%

2-3%

B1 Vacancy*, %

7-8%

13-14%

13-14%

Source: Colliers . EUR/sqm/month; *-speculative office market vacancy rate

In Q4 2021, the Riga office market saw the start of construction work on two new Class A projects (Elemental by Kapitel and Verde, stage II by Capitalica) in Skanste district. Development activity remains high with more than 110,000 sqm of Class A and 38,000 sqm of Class B office space under construction. Lack of notable additions to stock during 2021 as well as prospects for 1HY 2022 has resulted in increased interest from tenants in upcoming projects that might boost pre-letting activity. Preliminary data indicates that 2021 office take-up exceeded GLA 52,000 sqm, a significant increase compared to previous years’ average level of GLA 35,000 sqm. Some 37% of signed lease agreements are pre-leases. Rents for new projects are higher than for existing ones, though due to rising energy costs, new projects are in a somewhat better position because of expected lower additional costs. Tenants accommodated in older and non-energy-efficient buildings and those with non-capped indexations, might consider relocation during 1HY 2022 in order to reduce costs and improve working conditions.

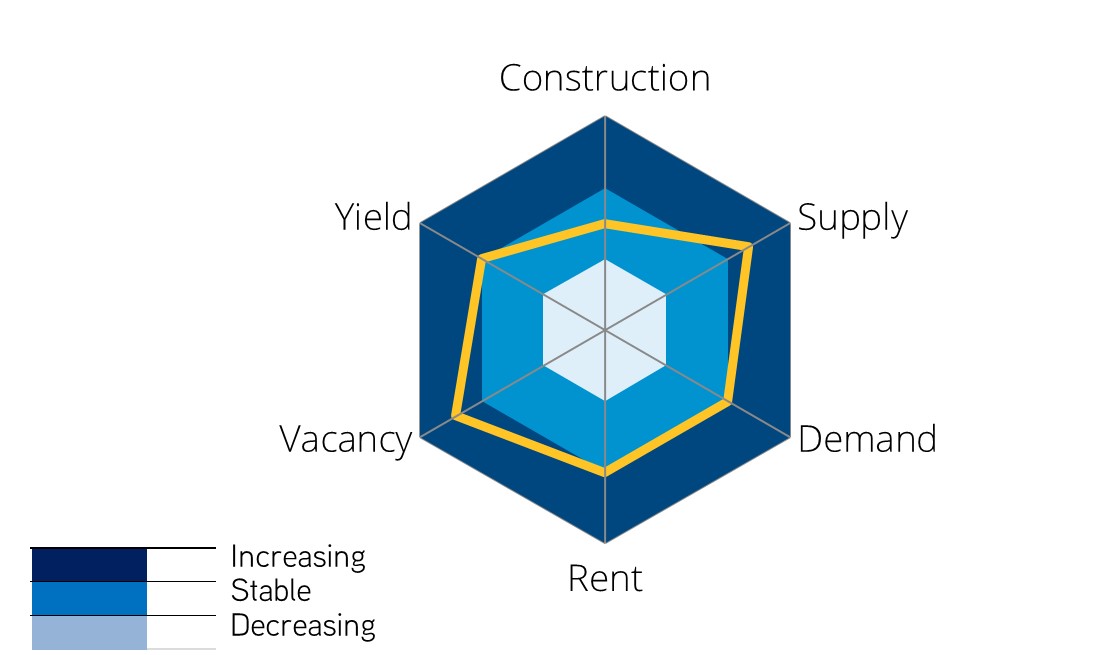

Office Trends

Source Colliers

In Q4 2021, the Vilnius office market expanded in the Class B1 office segment by GLA 9,500 sqm, following completion of the OFFICE 100 BC. Development of new office properties remained intense, recording construction start of Flow BC (GLA 15,000 sqm) in CBD. In total, 202,900 sqm of new leasable space was under construction at the end of the year. Office take-up in Q4 exceeded 23,800 sqm in total. The largest deal was a pre-lease agreement signed by Kevin EU fintech company for 4,000 sqm at Artery BC. Office rent rates demonstrated a slight increase compared to the previous quarter, mostly due to active take-up and rising construction costs. Tenants tend to occupy smaller but higher quality office space due to hybrid work practices.

As a result, vacancy in Class B1 office buildings in Vilnius slightly decreased compared to the previous quarter, while the Class A office segment stood roughly at the same level but is expected to see a decline.

Retail market

The retail sector continues to remain active in Tallinn metropolitan area, seeing ongoing and planned development activity in Tallinn’s neighbouring municipalities (e.g., IKEA, Tabasalu Centre, Prisma supermarkets in Saue, Maardu and Astangu, planned retail park in Kurna). Shopping centres continue diversification of their tenant mix to move more from retail properties to multifunctional social and business spaces. Viru Keskus gives a new look and content (more catering options, beauty and healthcare cluster) to the centre. Lintgen, the new owner of the T1 Mall of Tallinn, is planning to build a new entrance facing the rail line and Ülemiste Center and concentrate retail options on the first two floors, while the third floor is expected to have new functions – offices, sports and hobby activities, health services and public services. Grocery chains continue to secure market share and prepare for Lidl’s invasion in early 2022. Thus, Maxima opened two new stores in Tallinn region in Q4 2021.

The Riga retail market remains inactive, with no new projects added to the market and no new additions expected during 2022. The last quarter of the year began in a lockdown situation but, starting from mid-November, retailers selling non-essential goods were allowed to reopen, although stores with a total area exceeding 1,500 sqm are now allowed to operate only under a green regime (entry with a valid Covid certificate).

Retail Trends

Source Colliers

Up until Christmas, retailers selling only essential goods were allowed to operate during the weekends in shopping centres. Almost a two year-period with various restrictions have led to changes in how retail units are being planned and might stimulate development of retail parks in the Latvian market as separate entrances for each store have become highly desirable. The most significant market entry in Q4 2021 was the opening of the first 17 LIDL stores in Latvia. Additionally, in December, the first Pinko store in Riga opened in Spice, being one of the rare market entries by a fashion brand since the start of the pandemic. Tenants continue to ask for more support in the form of flexible working hours, step rents, and discounts, while tenant insolvencies are becoming a more common problem for landlords. Shopping centre vacancy levels are slowly improving but still remain high in Riga, while in the regions retailers struggle to find good quality vacant premises.

The Vilnius retail market completed the year in an active manner, recording completion of all three projects that were in the development pipeline (Vilnius Outlet SC, Senukai store and Pasilaiciai SC), which together increased retail stock by 73,900 sqm of leasable space. All three objects are positioned by Vilnius Western Bypass, which expands their catchment area. Akropolis Group announced plans to start construction work on Akropolis Vingis, a mixed-use project in Vilnius on the site of the former Velga factory. The dark store concept is picking up pace following the opening of the first Barbora and Blot Market stores in Vilnius. Domino’s Pizza has entered the market as a new brand, opening its first two restaurants in Vilnius. Vacancy in prime shopping centres in Vilnius slightly increased following completion of new retail projects, while pressure on rent rates continued to persist.

Key Retail Figures in the Baltic States, Q4 2021

Tallinn

Riga

Vilnius

Prime SC Rents*

23-45

23-40

25-50

Prime High Street Rents*

25-40

15-30

25-50

Vacancy in SC

4.5%

6.7%

2.8%

Source: Colliers . *EUR/sqm/month; SC – shopping centre

Industrial market

The industrial segment remains rather active in Tallinn and its suburbs in terms of new developments with a total area of approx. 168,075 sqm (52 projects) under construction in December. Development of stock-office premises continues to trend upwards with at least 56,575 sqm (17 projects) remaining under construction as retailers continue to generate the strongest demand for new space. Announced completion of thirty-four Stock Office projects will make an additional 141,500 sqm of new commercial and warehouse stock-office space available to the market in 2022-2023. Rents for newly built premises are expected to trend upwards due to growing construction costs. Due to buoyant demand, vacancy slightly decreased to 3.3%.

Key Industrial Figures in the Baltic States, Q4 2021

Tallinn

Riga

Vilnius

Prime Rents*

3.8-5.1

4.0-4.7

4.0-4.9

Vacancy

3.3%

3.4%

0%

Source: Colliers . *EUR/sqm/month

In Q4 2021, the Riga market saw completion of construction work on 3 buildings in A6 Logistics Park, bringing over 27,000 sqm of new logistics space to the market. VGP started construction work on VGP Park Tiraine (28,000 sqm of B-t-S warehouse space). Unlike previous quarters, an increasing proportion of lease agreements were signed during the pre-lease period. As the majority (around two-thirds) of projects under construction are built-to-suit projects, vacancy in in-stock properties has been decreasing. As a result, growing activity by tenants leasing new-build projects before completion is expected to persist in 2022. Take-up continues to be driven by companies from the transport, logistics, and 3PL sectors, which helped to decrease vacancy from 4.5 to 3.4%. Due to the lower availability of premises in the Ring Road region, headline rents there have risen from 3.5 to 4.0 EUR per sqm.

In Q4 2021, the Vilnius warehouse market grew by GBA of 16,200 sqm with two new projects completed for Vilpra’s and Komfovent’s own needs. The development pipeline in Vilnius remained active with over 91,700 sqm under construction at the end of 2021, of which over 81% was speculative. Rents remained stable, though are expected to increase somewhat, as developers have amortized most of the increased construction costs themselves. Without new additions to the Vilnius speculative warehouse market, there was no vacancy as in the previous quarter, a trend expected to continue in 2022, as most upcoming new supply is leased out in advance. Tenants with urgent expansion needs will have to settle for more expensive space in several smaller projects and sign contracts for 2023.

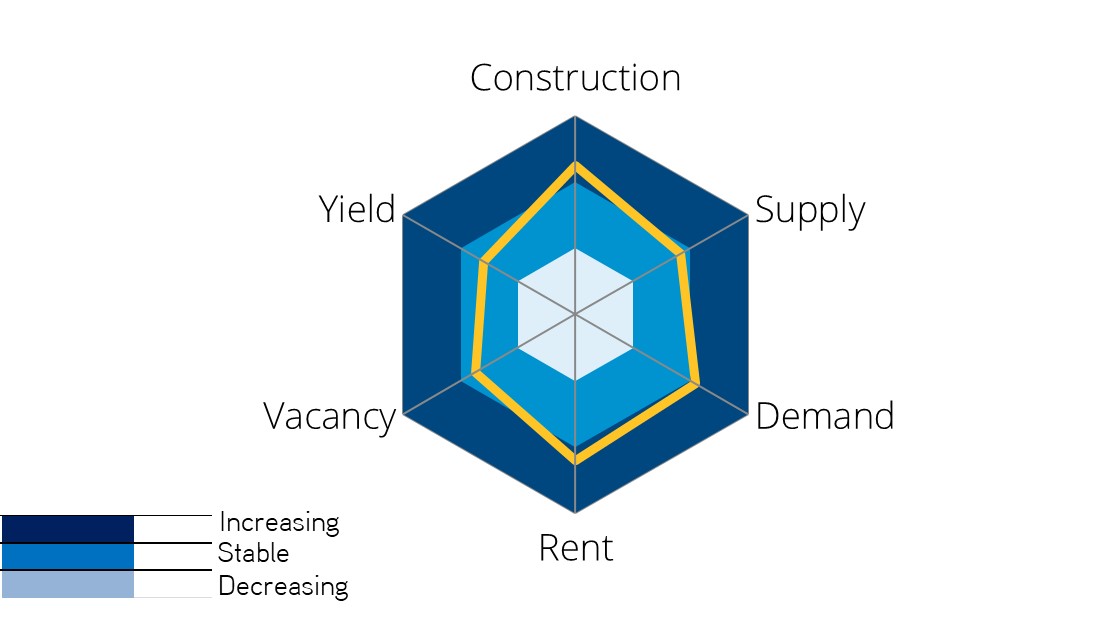

Industrial Trends

Source Colliers

Trends for 2022

- As real estate has been always seen as a good hedge against inflation, interest in investments in cash-flow objects during a high-inflation period is expected to remain high.

- Investors are expected to continue the hunt for industrial assets due to favourable market fundamentals.

- Compressing yields should encourage owners to make positive sales decisions, especially in the sale-leaseback segment.

- Total investment volume in the Baltics is expected to exceed the EUR 1 billion threshold in 2022.

- Lack of attractive high-grade investment objects will keep a significant part of investments directed into development projects.

- Higher quality small/medium sized office space will remain in demand as more companies are adapting a hybrid workplace strategy.

- Conversions of Class B office buildings to well-prepared (alternative) concepts will remain popular.

- 2022 will reveal if the long-awaited green and ESG target-compliant office space will result in higher take-up and pre-lease activity and bring newcomers to Riga.

- Refurbishment, expansion, improvement and diversification of the tenant mix will remain on the main agenda for landlords and retail investors.

- In order to recover customer flows and compete with e-commerce, shopping centres are likely to focus more on adding multifunctionality – more social, business and healthcare functions, live experiences and even entertainment.

- New development in the retail segment will continue to be led by discounters and grocery operators located in neighbourhood retail units, taking away the focus from traditional shopping centres.

- Low (large-scale) industrial development activity in the speculative segment might keep rent rates high and lead to higher pre-lease activity.

- In 2022, the market is expected to see lively activity in the Stock Office segment in terms of new commissioning and take-up in all three Baltic States.

- Rising construction costs are impacting the pace and potential of further development activity.

Contact

Maksim Golovko

Research & Forecasting | Estonia

Colliers International Advisors

Estonia Office

+372 6160 777

Toms Andersons

Research & Forecasting | Latvia

Colliers International Advisors

Latvia Office

+371 67783333

Dominykas Lusys

Research & Forecasting | Lithuania

Colliers International Advisors

Lithuania Office

+370 5 2491212

colliers.lithuania@colliers.com

© 2022 :: Colliers International